For the second year, we at CoVenture sent a year-end letter to our limited partners. We’re sharing it here, with only confidential information edited out.

To our investors and friends,

As we kickoff 2017, we want to take this opportunity to look back on another eventful year for CoVenture. We also want to share our observations from 2016, assess the veracity of our prognostications for the past year, and make some new predictions for 2017 for the markets in which we invest. This letter is light on specifics with respect to our portfolios; more detail to come in our full fourth quarter reports.

Year in Review

In this section, we’ll share our thoughts and observations on the year just ended, first regarding our firm, then the venture capital market, and, finally, the online lending and credit markets. We’ll conclude our review of 2016 by taking a hard look at the predictions we made as the year began.

CoVenture

It was a busy year at CoVenture. In the past twelve months, we:

- Raised an equity round of financing to help support and expand our team;

- Re-organized our corporate structure, setting up a holding company, a new management company, our technology consulting company, and infrastructure to manage a larger number of funds;

- Made six new investments from CoVenture III;

- Closed our first four investments in CoVenture IV;

- Expanded our lending funds;

- Led the series A of Produce Pay;

- Opened an engineering office in Ottawa, which currently employees four members of our product team;

- Increased the size of our New York team, adding five members who help us with fundraising, due diligence, product development and operations;

- Added Marc Spilker (former president of Apollo) and Rick D’amico (partner at GPS Investment Partners) to our Advisory Board;

- Moved into our first dedicated office (we finally succumbed to paying rent!).

We were also able to maintain strong fund performance while managing this substantial growth in our business. [Details redacted.]

In summary, we believe we have shown an ability to attract capital and execute on interesting investment opportunities in both our venture capital and credit businesses. In 2016, we put in place the next layer of the foundation of our team to enable us to pursue continued expansion of these businesses through additional fundraising and investment in 2017 and beyond.

Venture Capital Market

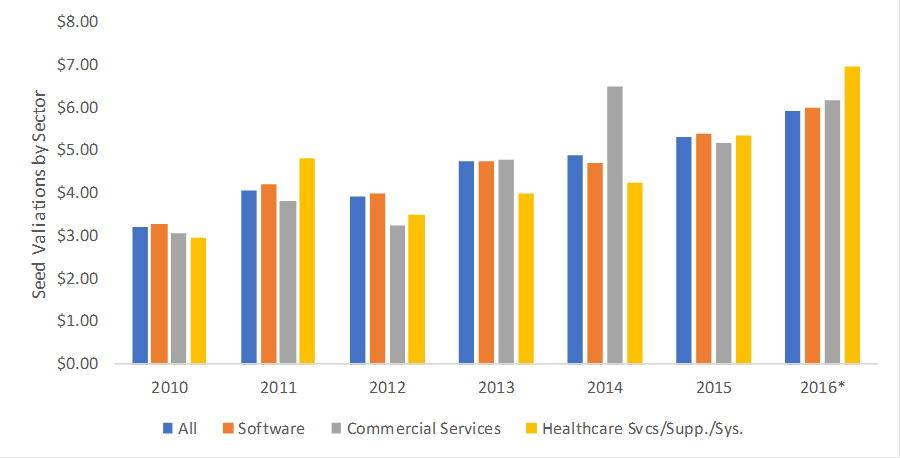

In 2016, we saw a continued trend of increasingly expensive deals. According to PitchBook, the median estimated seed valuation for 2016 was $5.9 million compared to $5.3 million in 2015. AngelList reports a similar magnitude of increase in the last 12 months. Likewise, the median round size for seed financings jumped from $1 million to $1.5 million in the same time frame.

Source: PitchBook

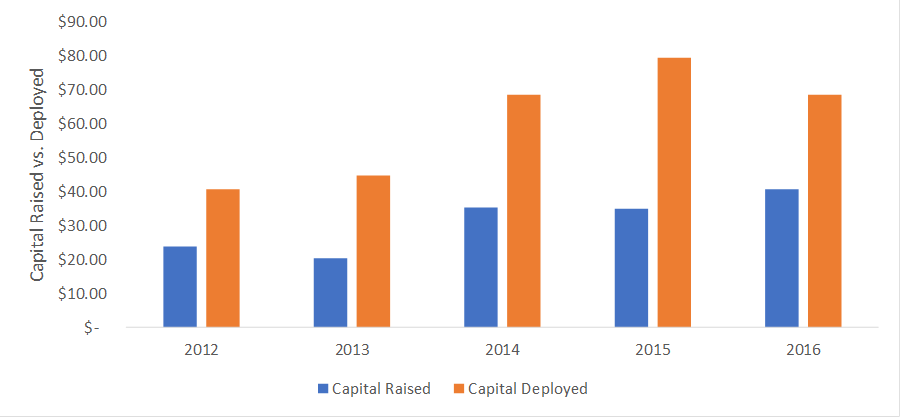

2015 was notable for an increase in capital deployed as well as inflated valuations. In contrast, 2016 showed an almost 14% drop in capital deployed and a nearly 25% drop in the number of deals completed. Paradoxically, the total capital raised by venture capital firms in 2016 was a record high. The success that firms had in raising capital in 2016 reflects, in part at least, limited partners’ search for yield in a persistently low-interest-rate environment.

For the last several years, capital deployments have outpaced new capital raised, indicating that funds’ “dry powder” is steadily being burned down and the market is not in a significant capital overhang position. But Venture capital, like Private Equity, is cyclical in nature and, if the trend persists, we could see a capital overhang problem develop. We are not an actual inflection point yet, but it is notable and worth monitoring.

Source: PitchBook

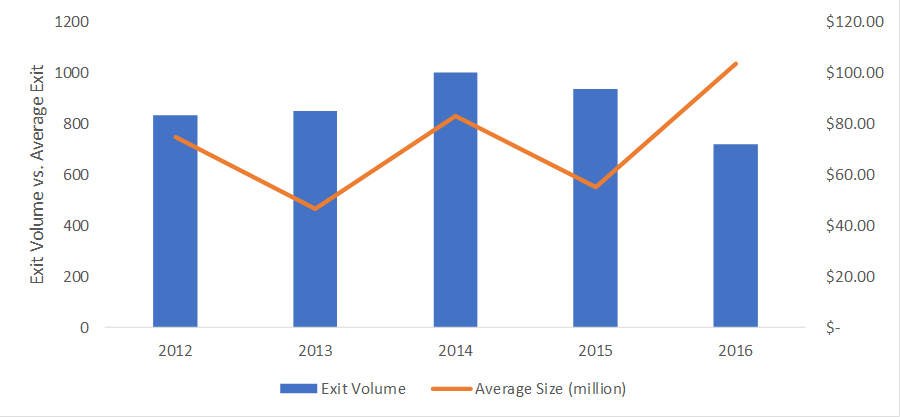

In 2016, we also saw an increase in investment dollars per deal – a trend that began in 2015 – suggesting that investors continued to allocate larger amounts of capital to follow-on investments and to companies that have already shown traction. In some cases, this kind of continued investment in later-stage companies was necessary because of the limited window for public offerings of late.

The other half of the venture equation is exits. Overall, exits became larger and scarcer in 2016. Last year saw a 23% drop in the number of VC-backed company exits but an increase of almost 45% in total exit value compared to a year earlier. As a result, the average exit size nearly doubled from $55M to over $100M.

Source: PitchBook

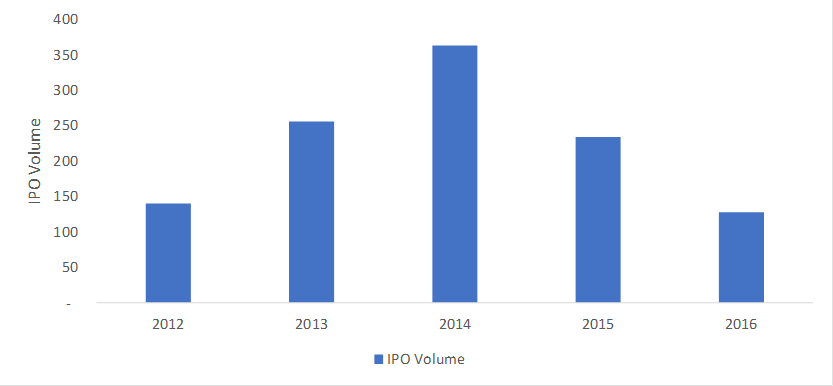

From a macro perspective, big expensive deals require big exits, and those are much more likely when the IPO window is open. Therefore, returns in today’s market – of increasingly mature companies raising more, larger, later rounds of private capital – are more sensitive to IPO markets than in past years.

Below is a chart of IPO filings over time. 2016 showed a near record low for IPOs (despite IPOs increasing in offering size). Optimistically, one could look at this chart and conclude that mean reversion would indicate that public markets must open up further at some point. More on that in the section concerning 2017.

Source: Renaissance Capital

Online Lending & Credit Markets

We are adding a section on online lending and credit to our letter this year. Our credit business expanded significantly in 2016, giving us enhanced focus and perspective on these markets.

In short, online lending platforms have fallen out of favor with equity investors. In January, 2015 Lending Club’s share price was $22.89. As of this writing, it is $5.74. Over the same span, OnDeck’s share price dropped from $22.73 to $5.10.

This unfavorable market reaction has created a renewed opportunity to invest in both the debt and the equity of these businesses. In 2015, lending startups were being valued as tech marketplaces, rather than as tech-enabled financial services businesses, which meant that they were overvalued. In fact, we saw online lending platforms raising series B funding rounds at 30x revenue during that period. But today, a lack of competition for equity investment in these companies has helped increase our deal flow and improve our position in the market.

What has not gone out of vogue, however, is investor demand for yield and income. As mentioned in the last section, one reason so much capital flowed into venture capital in 2016 was because investors were finding it very difficult to find other sources of capital appreciation (despite their need to match liabilities or live up to the promises they had offered to constituents and clients).

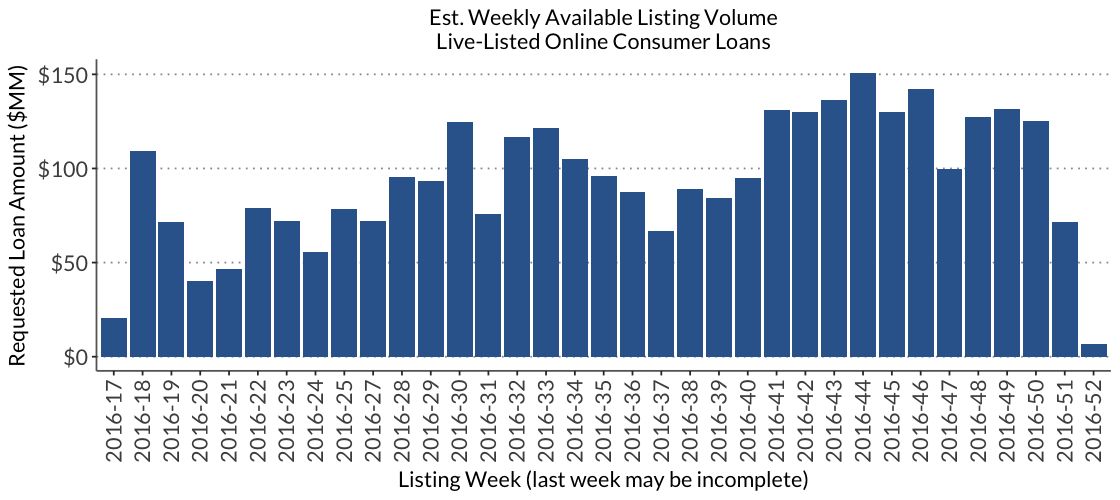

So, while many expected demand for online loans to follow decreased demand for Online Lending platform equity, it did not. Many believed the LendingClub fiasco might have caused investors to pause their pursuit of loans originated online, but the market remained more resilient than expected.

LendingClub fired its CEO, increased rates and tightened its credit standards. Prosper had difficulty selling its loans, so issued warrants to juice their returns. And these measures, while publicized in a negative light, kept demand for loans steady. These measures indicate that online lending platform companies began prioritizing their investors over their borrowers.

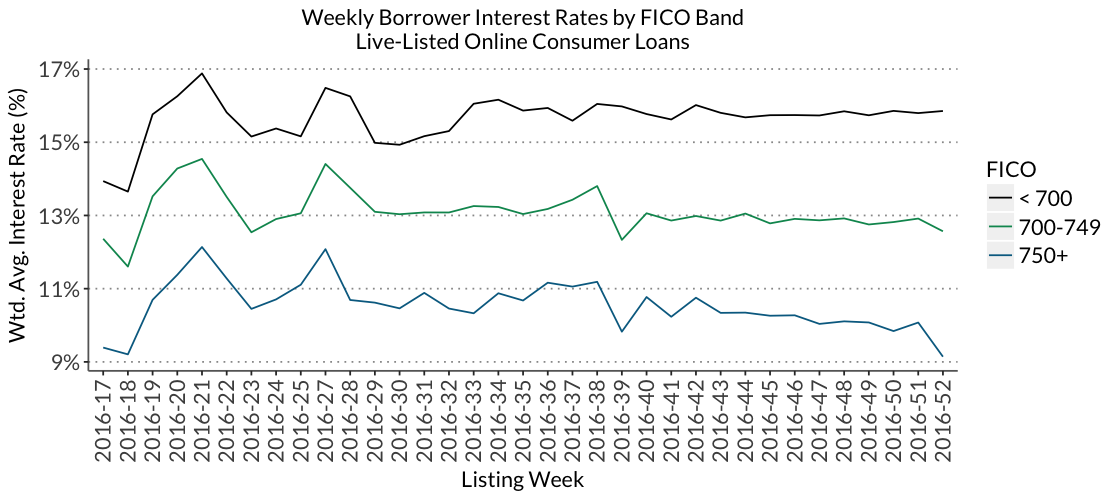

Equally impressive was the fact that even though rates went up, borrower demand remained strong:

Source: Orchard Lending

In the beginning of 2016 we saw a correlation between prime, super-prime and sub-prime borrowers, but these rates diverged at the end of the year, creating a greater spread between borrowing groups. This tightening of lending standards helped salvage the reputation of online lenders, but has also made the loan products LendingClub and its peers offer appear more like those of a traditional bank. These platform providers, in other words, began ignoring the very consumers that other more traditional lenders have long eschewed.

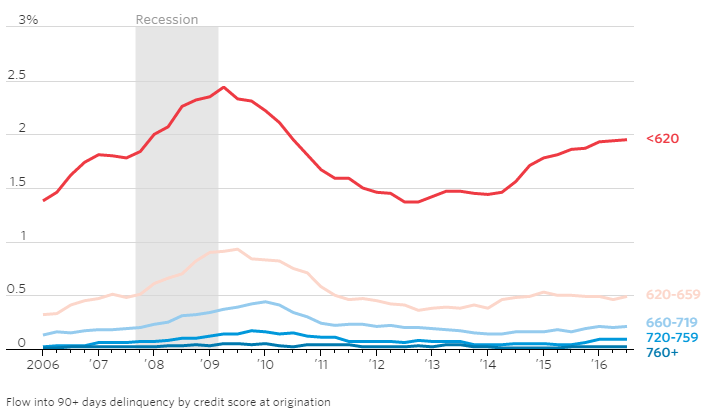

More broadly, 2016 further demonstrated that consumer credit markets may face a pullback in performance.

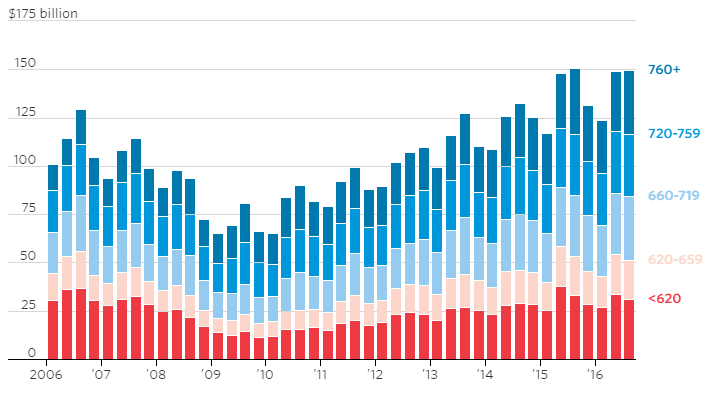

The auto-lending industry, specifically, has received close attention.

Both a softening used car market and increased default rates have caused a slowdown in auto loan originations. A particularly large hike in sub-prime delinquencies has come at a time when values of used cars up to eight years old are down 3.6% in 2016 versus the same period a year earlier, according to the NADA Used Car Guide. Additionally, according to the Wall Street Journal, auto lenders on average recovered 54.3% of outstanding loan balances that were in default, bankruptcy or charge-off status in September of 2016, down from 56.4% a year prior. In the third quarter of 2016, origination of subprime auto loans slowed, but market forces are playing out to create large losses in the auto finance vertical if investors are not cautious.

Source: New York Fed Consumer Credit Panel / Equifax

Auto Loan Origination by FICO Credit Score

Flow into 90+ Days Delinquency by Credit Score at Origination

So far caution has been evident, as lenders have started to show a pullback in originations, fearing a continued or more acute lack of performance. This pullback, coupled with increased tightening of credit standards by online lenders has created a lack of access for non-prime borrowers.

The good news is that it’s hard to have a “crisis” when everyone is paying attention; the bad news is that non-prime borrowers are increasingly underserved.

Looking Back at Our Predictions for 2016

At the beginning of the year, in our last annual letter, we offered a number of reasonably specific predictions for 2016, beyond broad statements about our markets. In our view, many people prognosticate at this time of year, but not enough offer honest assessments of their prior predictions. Here we attempt to do just that:

Prediction: Virtual Reality will be mainstream

Verdict: Correct

Evidence: The market is rapidly maturing. In the last year, the HTC Vive and Oculus Rift were released and captured the high end of the market. The Samsung Gear became one of the most popular VR devices and Google is still giving away it’s Cardboard (VR Headset) for free.

Prediction: Computer Science becomes the Fourth “R”

Verdict: Mostly Correct

Evidence: It’s clear that Computer Science is an important part of education and it has been proposed as an addition to the Common Core standards. In 2016, Florida approved a bill that allows students to take coding classes in place of traditional foreign language classes. We’re calling this one mostly correct because it is directionally right but we still have a long way to go.

Prediction: The CleanWeb Emerges

Verdict: Not Quite There

Evidence: Technology can reduce waste by increasing utilization of assets (car sharing, apartment sharing) beyond what any individual can do. Our prediction was that this trend of efficient resource utilization would continue with a focus on environmental impact. However, most of the movement in environmental concerns is centering around the data center; building more efficient computing hardware and providing renewable energy to data centers.

Prediction: Compliance in Untested Financial Institutions

Verdict: Correct…..for now

Evidence: It’s clear from our deal flow that there are an increasing number of peer lending platforms and we expect this trend to continue. This past year the Consumer Financial Protection Bureau started accepting complains about non-traditional lenders and is increasing scrutiny in non-bank mortgage originations. That said, the recent political climate may change this trend as President-elect Trump is expected to curtail the power of the five-year-old agency.

Prediction: Paid Content Makes a Comeback

Verdict: Correct

Evidence: There have been a flurry of new companies released in the last year that all focus on helping publishers who produce long for content get paid. Blendle launched in the United States allowing for micro payments for high quality journalism and Discors launched offering rich news analysis for a subscription fee. Payment for quality content was a prominent theme in Matter’s class this year (they are a media focused VC.) We’ll double down on this prediction and expect this trend to continue.

Looking Ahead to 2017

CoVenture

Over the past couple of years we believe we have: (1) assembled a strong team (2) observed early portfolio performance that supports our investment theses (3) generated significant deal flow from sources that “call us first” and (4) developed a core investor base that has enabled us to raise both discretionary funds and special purpose vehicles that have given us the flexibility to pursue exciting, complementary investment opportunities.

In 2017 we will focus on institutionalizing our internal infrastructure. We will use the equity capital we raised to over-invest in personnel and service providers who will allow us to operate with the efficiency of a fund with a larger asset base than we currently have in order to set the table for continued growth. We have already made a number of key hires to help us do so, and we expect to make a one or two more. Our primary focus will be on improving our reporting and creating more lines of communication between us and our investors.

Our other primary focus will be on establishing our brand within both the startup and LP worlds. We will be investing – judiciously – in marketing in 2017, which we hope will establish us as thought leaders in the world of product development, will continue to help us win deals based on brand awareness, and will allow us to more easily raise institutional capital.

Throughout 2014-2016 we proved that we could make smart investments and create early returns for our investors. In 2017 we will be focused on setting up scalable infrastructure and stepping on the gas pedal.

Venture Capital Market

Venture capital firms raised a record amount of fresh capital in 2016 and deployed less than a year earlier in fewer deals than they had closed in five years. If managers are to keep their jobs, they cannot continue to sit on capital; we expect them to begin to increase their investment pace in 2017. As investors become more active, we may see an increase in valuations. We believe CoVenture would likely benefit from such an increase, as we invest in earlier-stage companies than most firms, and our software development capability is a significant source of differentiation. That said, the trend toward fewer, larger financings across stages will likely continue, for two reasons. First, firms will continue to use capital from earlier vintage funds to support the “winners” in their portfolios that have not yet exited but need larger cash infusions to continue growth. Second, a number of very large funds, which tend to write larger checks, were raised in 2016: just five funds – Baidu, TCV, Andreessen Horowitz, Founders Fund and Norwest – accounted for $9.5B of the total ~$40B raised for the year.

The significant dip in the number of VC-backed exits, particularly in the form of IPOs, in 2016 will put that much more pressure on managers to find exits in 2017. We expect an uptick in public offerings, assuming the markets are at all receptive. We may see more M&A activity as well, as investors seeking exits who cannot access the public markets may be that much more willing to accommodate strategic and private equity buyers, who continue to show an interest in acquiring growth and innovation for reasonable prices.

All in all, then, we expect both more investing and exit activity in the year ahead. Even so, don’t be surprised if that activity does not reach full swing until spring or early summer, after the new Administration has made the priorities for its first 100 days clear and both public and private markets have adjusted accordingly.

Predictions for 2017

Non-Prime Consumers Will Have New Credit Options

Negative signals in consumer credit markets, along with tightening credit requirement by online lenders, will continue to cause lenders to pull back originations to non-prime borrowers. This will leave these borrowers increasingly underserved.

But de-regulation and a new Republican administration will reduce fear of regulatory intervention in credit markets, leading entrepreneurs to develop new offerings for this market that LendingClub and its ilk once served. Many of the founders of these companies will come from more traditional lending backgrounds, and the investors who back them will be vertically focused. They will also be structured and valued more like traditional lending businesses (rather than like marketplaces). The days of valuing a financial services business off of a multiple of originations are over.

And up until 2016, online lenders focused their innovation around finding unique ways to originate loans. But going forward, innovation in lending will increasingly revolve around new ways to underwrite loans and truly new financial products. This type of innovation will be especially important if non-prime borrowers are to receive the capital they need at fair rates.

We believe endowments, insurance companies, pension funds and other institutional investors will continue to invest in online loans as they continue to hunt for yield. But they will demand better controls, tighter covenants and higher rates from these platforms as compensation for the risks inherent in short loan tapes and new operations.

Venture Capital Firms Become Diversified Asset Managers

VC firms have begun and will continue to implement diversification strategies. More and more seed stage funds have set up “opportunity funds” which act as “growth equity funds.” A handful of venture capital funds have set up their own direct lending funds (Arena Ventures and Greycroft being two examples). And many VC firms are setting up multiple funds to tackle various verticals (500 startups as both geographically focused funds, and Andreessen Horowitz has vertically focused funds).

We will be investing in an ecosystem with more creative and tailored financing strategies than ever before.

We’ll Be Talking to Our Computers More

Voice response systems have been a long time coming, but they have arrived. We have all dealt with them in phone trees for some time, but the pieces are now in place for these systems to be much more prevalent and helpful across a variety of circumstances. Our cars have been listening to us for a while, but now they can make reservations and send e-mails in addition to giving directions. Siri and Google have been available on our phones for some time now, but AirPods will make Siri a much more natural conversation companion. And two technology giants have opened up voice response as the latest front in the battle for the home, with Amazon and Google pouring dollars into the development and marketing of Echo and Home, respectively. Even so, there is still much to do to improve the interfaces and, most importantly, increase the number of applications available on each of and across these now nearly-ubiquitous platforms. Several years ago, it seemed that Google Glass and its competitors might constitute the next paradigm in computing interface. It now appears that the next important platform may not be sight, but voice. Many of us are already talking to our computers, but, in 2017, we’ll have much more to talk with them about.

New Trusted News Sources Emerge

Television news viewership is down, and newspaper readership is declining even faster. News channels, with dwindling foreign correspondent budgets and pressure for ratings, typically cater to the lowest common denominator of their audiences, spending precious little time on reporting and analysis of the most important international stories. Social media sites, which one might have expected to fill the void, create echo chambers for opinion as well as so-called fake news. And in 2016, fake news seemed to have had an impact on elections in the U.S. and elsewhere and elicited threatening comments from one nuclear power (Pakistan) concerning another (Israel). In short, the dearth of timely, trustworthy, unbiased news sources has recently been widely recognized for what it is – a threat to peace and progress. Smart entrepreneurs have already realized that this problem is an opportunity to create new platforms for news. Vice is a pioneer in this space, having added an on-demand, half-hour international news program to its media offerings in 2016. Incumbents like National Public Radio, with its One app, and the New York Times with its virtual reality reporting, have also made attempts to innovate their news offerings. We expect to see more attempts to create new news platforms, both from incumbents and new entrants, in 2017.

Everybody Gets a Chat Bot

Chat bots will see an explosion in popularity in 2017. In many ways, they are the text equivalent of the voice interactions mentioned above. They combine simple user interactions with basic intelligence to allow for more human interactions with technology. Google and Microsoft have been leading the way building artificial intelligence chat services. On a more practical level, there are several Chat-Bot-As-A-Service platforms, purpose built white label chat bots, and dozens of frameworks for building chat bots. Businesses are looking for new ways to engage with customers and to cut through the noise. The result is an environment fertile for rapid chat bot expansion.

Zero-Rating and Weakened Net Neutrality Will Harm Competition

Even in 2017, most of the United States population have an explicit or implicit data cap on their mobile phone and in many cases the same is true for their home connection. The result is that services, especially mobile services, have a measurable impact on a customer’s bill.

T-Mobile, AT&T and other carriers offer what is known as zero-rating on selective services. This means that a customer can stream Spotify without having to worry about their data caps. While this appears to be a benefit to customers, the reality is that it puts a massive barrier up for new streaming services. If a new streaming service launches, it will effectively be more expensive because it will consume the customer’s data cap.

While this prediction may be the hardest to measure, we suspect it will have a long term negative impact on innovation. The changing political climate embraces new zero-rating options will lead to a proliferation of preferential data treatment.

Conclusion

We are optimistic about the year ahead in the venture capital and alternative lending markets. We expect fresh capital, an uptick in exit activity, and continued innovation across a variety of industries to drive a healthy venture capital market. Meanwhile, a friendlier regulatory environment and a dearth of non-prime credit offers will provide fertile ground for new credit innovation. We have attempted to invest in our team to position ourselves to take advantage of these kinds of opportunities, and plan to continue to lay the groundwork for growth as we pursue those opportunities in 2017.